what percentage of taxes are taken out of my paycheck in ohio

The bonus tax calculator is. The income tax brackets have shifted with those making between 38701.

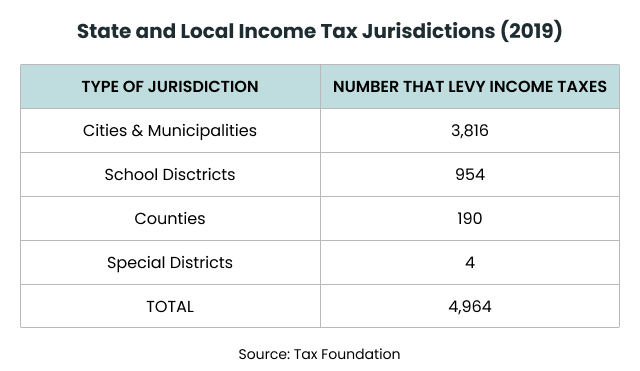

Income Tax Definition What Are Income Taxes How Do They Work

Federal tax rates like income tax Social Security.

. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck. They take a big bite out of paychecks each month and just how big depends on where you live. What percentage of taxes is taken out of paychecks in Virginia.

You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck. Ohio Hourly Paycheck Calculator. The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

This article is part of a larger series on How to Do Payroll. This would apply to churches schools and other charities that are permitted to issue W-2Gs to the. Amount taken out of an average biweekly.

Discover Helpful Information and Resources on Taxes From AARP. 62 of each of your. Calculates Federal FICA Medicare and.

How much does Ohio take out of your paychecks for taxes. Ad Compare Your 2022 Tax Bracket vs. Due to the Tax Cuts and Jobs Act you may see a change in the taxes coming out of your paycheck.

If you had 50000 of taxable income. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. This would apply to churches schools and other charities that are permitted to issue W-2Gs to the.

Ohio does not require withholding taxes to be taken out of prize winnings for non-profits. Both employee and employer shares in paying these taxes. 27 rows FICA contributions are shared between the employee and the employer.

Both employers and employees are responsible for payroll taxes. To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Actually you pay only 10 on the first 9950.

You pay 12 on the rest. Your 2021 Tax Bracket to See Whats Been Adjusted. FICA taxes consist of Social Security and Medicare taxes.

These amounts are paid by both employees and employers. This free easy to use payroll calculator will calculate your take home pay. Total income taxes paid.

Supports hourly salary income and multiple pay frequencies. Look at the tax brackets above to see the breakout Example 2. For the first 20 pay periods therefore the total FICA tax withholding is equal to or.

The state of Ohio takes out 200 dollars. If youre single and you live in Tennessee expect 165 of your paycheck to go. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Add up all your tax payments and divide this amount by your gross total pay to determine the percentage of tax you pay. After a few seconds you will be provided with a full breakdown of the. For example if your gross pay is 4000 and your.

For 2021 employees will pay 62 in Social Security on the. Ohio does not require withholding taxes to be taken out of prize winnings for non-profits. What is the percentage of federal taxes taken out of a paycheck 2020.

Amount taken out of an average biweekly paycheck.

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Much Should I Set Aside For Taxes 1099

Ohio Paycheck Calculator Smartasset

2022 Federal State Payroll Tax Rates For Employers

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Breakdown Of Local And State Ohio Taxes

My First Job Or Part Time Work Department Of Taxation

What Are Salary Taxes For Software Engineers In The Usa Quora

Ohio Paycheck Calculator Smartasset

State Income Tax Rates And Brackets 2022 Tax Foundation

Spotlight On Ohio Local Taxes Local Taxes Local Tax Compliance

Here S The Average Irs Tax Refund Amount By State

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Salary Paycheck Calculator Calculate Net Income Adp

What Are Employer Taxes And Employee Taxes Gusto

Tax Withholding For Pensions And Social Security Sensible Money